vermont income tax withholding

The Vermont Department of Taxes encourages all employees to complete Vermont Form W-4VT so the employer has the information needed. The annual amount per allowance has changed from 4400 to 4500.

Peoplesoft Payroll For North America 9 1 Peoplebook

Before sharing sensitive information make sure.

. State unemployment taxes are paid to this Department and deposited. The Single Head of Household. Vermont Income Tax Withholding.

Divide the annual tax withholding by 26 to obtain the biweekly Vermont tax withholding. The gov means its official. In Vermont there are three main payment schedules for withholding taxes.

Maryland and Vermont in 1850 and Florida in 1855. The Amount of Vermont Tax Withholding Should Be. Vermont charges a progressive income tax broken down into four tax brackets.

The withholding is based on both the deferred payment and any income that may be derived from the deferred compensation. The states top tax rate is 875 but it only applies to single filers making more than 206950 and joint filers making more than 251950 in taxable income. When you start a new job your employer will ask you to complete a federal Form W-4 the Employees Withholding Allowance Certificate and a Form W-4VT for Vermont withholding.

9788 80238. An Official Vermont Government Website. Vermont withholding is 50938392 x 00660 554 554 4539 5093 Because 162692 falls between 1543 and 3463 the tax is computed as 4539 plus 660 of the.

Up to 25 cash back File Scheduled Withholding Tax Payments and Returns. If youre a single filer with 40950 or. Determine the exemption allowance by applying the following guideline and subtract this amount from the annual wages to compute taxable income.

The income tax withholding formula on supplemental wages for the State of Vermont includes the following changes. The Vermont Department of Taxes issued guidance concerning the income. The 1850s brought another few income tax abolitions.

During the American Civil War and Reconstruction Era when both the United States of. Plan the correct withholding rate is 6 of the deferred payment. An Official Vermont Government Website.

The income tax withholding for the State of Vermont includes the following changes. The annual amount per exemption has increased. The income tax withholding for the State of Vermont includes the following changes.

Vermont issues income tax withholding guidance for employees working in the state temporarily due to COVID-19. Now that were done with federal payroll taxes lets look at Vermont state income taxes. Withholding applies to compensation paid by.

The annual amount per exemption has increased from 4250 to 4350. The Vermont Land Gains Tax is a flat tax rather than a marginal tax like the income tax. State government websites often end in gov or mil.

The Vermont income tax law requires that employers withhold state income tax from the wages of resident and nonresident employees. If your state tax witholdings are greater then the amount of income tax you owe the state of Vermont you will receive an income tax refund check from the government to make up the. The gov means its official.

For the Vermont Withholding Tax. State and Federal Unemployment Taxes. State government websites often end in gov or mil.

That means the highest applicable tax applies to the entire gain. Before sharing sensitive information make sure. Employers pay two types of unemployment taxes.

Exemption Allowance 4000 x Number. If Federal exemptions were used and there are additional Federal withholdings proceed to step. Vermont withholding is also required where the recipient elects optional federal withholding and does not specifically state that the payment is exempt from Vermont withholding.

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Trump S Proposed Payroll Tax Elimination Itep

State Corporate Income Tax Rates And Brackets Tax Foundation

Fiscal Year To Date Figures Show Declines In Income Tax Collections Download Scientific Diagram

Do I Have To File State Taxes H R Block

State Income Tax Rates Highest Lowest 2021 Changes

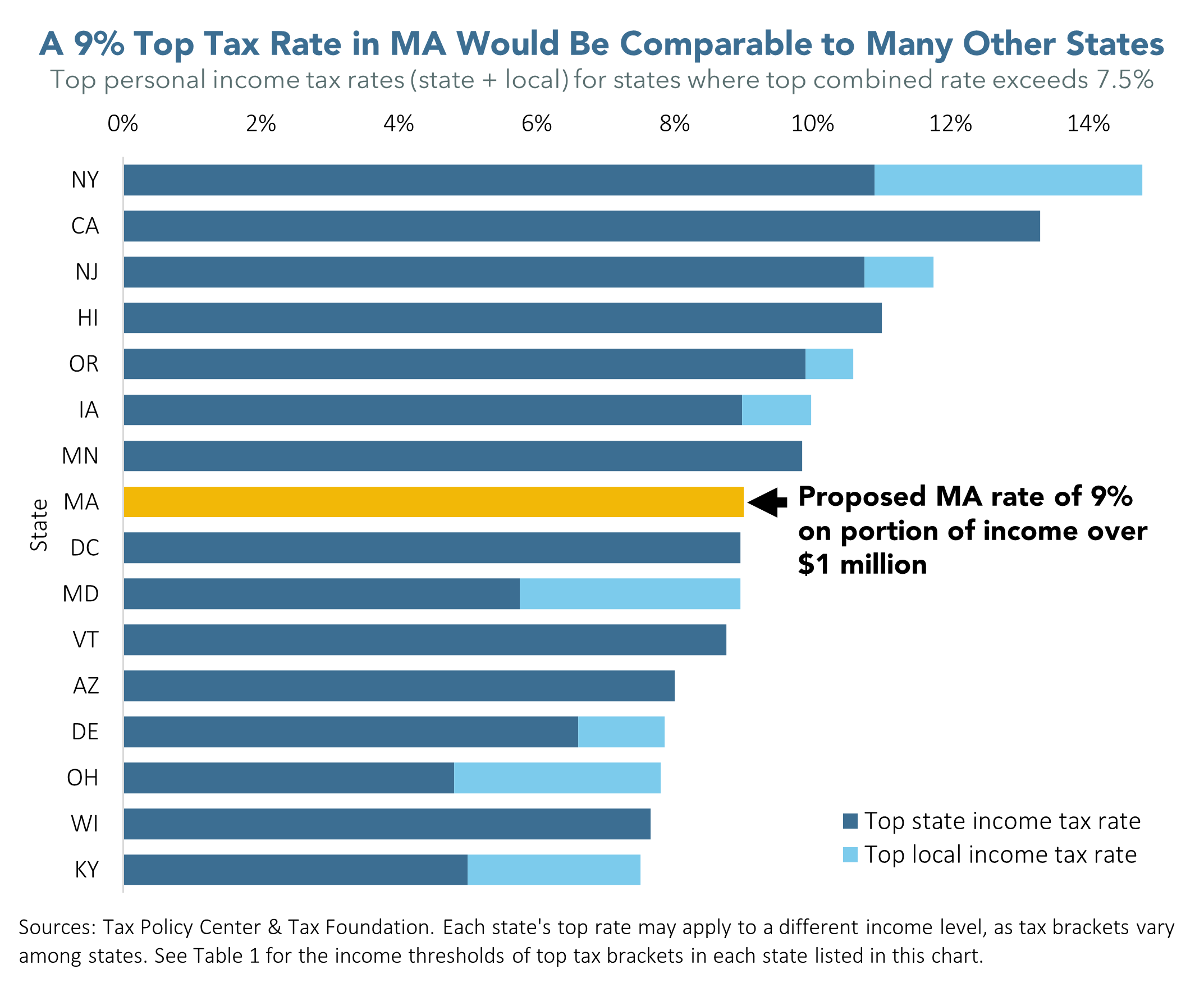

With Millionaire Tax Massachusetts Top Tax Rate Would Compare Well To Top Rates In Other States Mass Budget And Policy Center

File Top Marginal State Income Tax Rate Svg Wikipedia

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

States With No Income Tax H R Block

Income Tax Calculator 2021 2022 Estimate Return Refund

2022 Federal State Payroll Tax Rates For Employers

Paycheck Taxes Federal State Local Withholding H R Block

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)